idaho sales tax rate 2020

The County sales tax rate is. This is the total of state county and city sales tax rates.

Texas Taxable Services Security Services Company Medical Transcriptionist Internet Advertising

The maximum local tax rate allowed by Idaho law is 3.

. Also the Idaho State Tax Commission sets property tax values for operating property which consists mainly of public utilities and railroads. Boise ID Sales Tax Rate. Prescription Drugs are exempt from the Idaho sales tax.

Wayfair Inc affect Idaho. Taxes are determined according to a propertys current market value minus any exemptions. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate.

Some but not all choose to limit the local sales tax to lodging alcohol by the drink and restaurant food. Simplify Idaho sales tax compliance. The Boise sales tax rate is.

Sales Tax Distribution by County for 122020 02-03-2021 SPTD BaseExcess S3 Sales Tax Distribution by County for 122020. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. The Idaho State Tax Commission collects data and prepares reports on a range of topics.

Idaho tax forms are sourced from the Idaho income tax forms page and are updated on a yearly basis. Click here to get more information. Most homes farms and businesses are subject to property tax.

Once their tax rates percentages are added to the citys rate the total rate for Georges property is 001352. Cities with local sales taxes. County fire highway library school sewer ambulance and weed control.

Depending on local municipalities the total tax rate can be as high as 9. The Idaho ID state sales tax rate is currently 6. Avalara provides supported pre-built integration.

Idaho has a statewide sales tax rate of 6 which has been in place since 1965. Tax Rate. The December 2020 total local sales tax rate was also 6000.

Idaho has state sales. The minimum combined 2022 sales tax rate for Boise Idaho is. Income tax rates for 2021 range from 1 to 65 on Idaho taxable income.

Find detailed examples in our Idaho Residency Status and Idaho Source Income guides. Plus 4625 of the amount over. Local level non-property taxes are allowed within resort cities if approved by 60 majority vote.

31 rows The state sales tax rate in Idaho is 6000. 100 of the market value of his house is 175000. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Download all Idaho sales tax rates by zip code. Raised from 6 to 7. Plus 3125 of the amount over.

280 rows Idaho Sales Tax. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. Plus 1125 of the amount over.

Individual income tax is graduated. Idaho has a 6 statewide sales tax rate but also has 116 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top of the state tax. Average Sales Tax With Local.

Plus 6625 of the amount over. For example homeowners of owner-occupied property. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax.

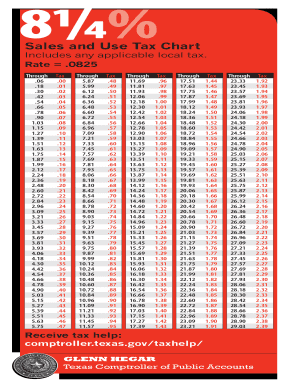

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. The current total local sales tax rate in Boise ID is 6000. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax.

Plus 3625 of the amount over. Contact the following cities directly for questions about their local sales tax. The Idaho State Sales Tax is collected by the merchant on all qualifying sales made within Idaho State.

The total amount of property tax that George owes is calculated like this. The 2022 state personal income tax brackets are updated from the Idaho and Tax Foundation data. Plus 5625 of the amount over.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Did South Dakota v. The Idaho sales tax rate is currently.

This means that Idaho taxes higher earnings at a higher rate. Cascade - 208. Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets.

With local taxes the total. While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected. In this case those districts are.

Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0 to 3 across the state with an average local tax of 0074 for a total of 6074 when combined with the state sales tax.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

States Without Sales Tax Article

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Tax Chart Fill Out And Sign Printable Pdf Template Signnow

Iowa Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Indiana Income Tax Rate And Brackets 2019

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

State Corporate Income Tax Rates And Brackets Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Tax On Grocery Items Taxjar

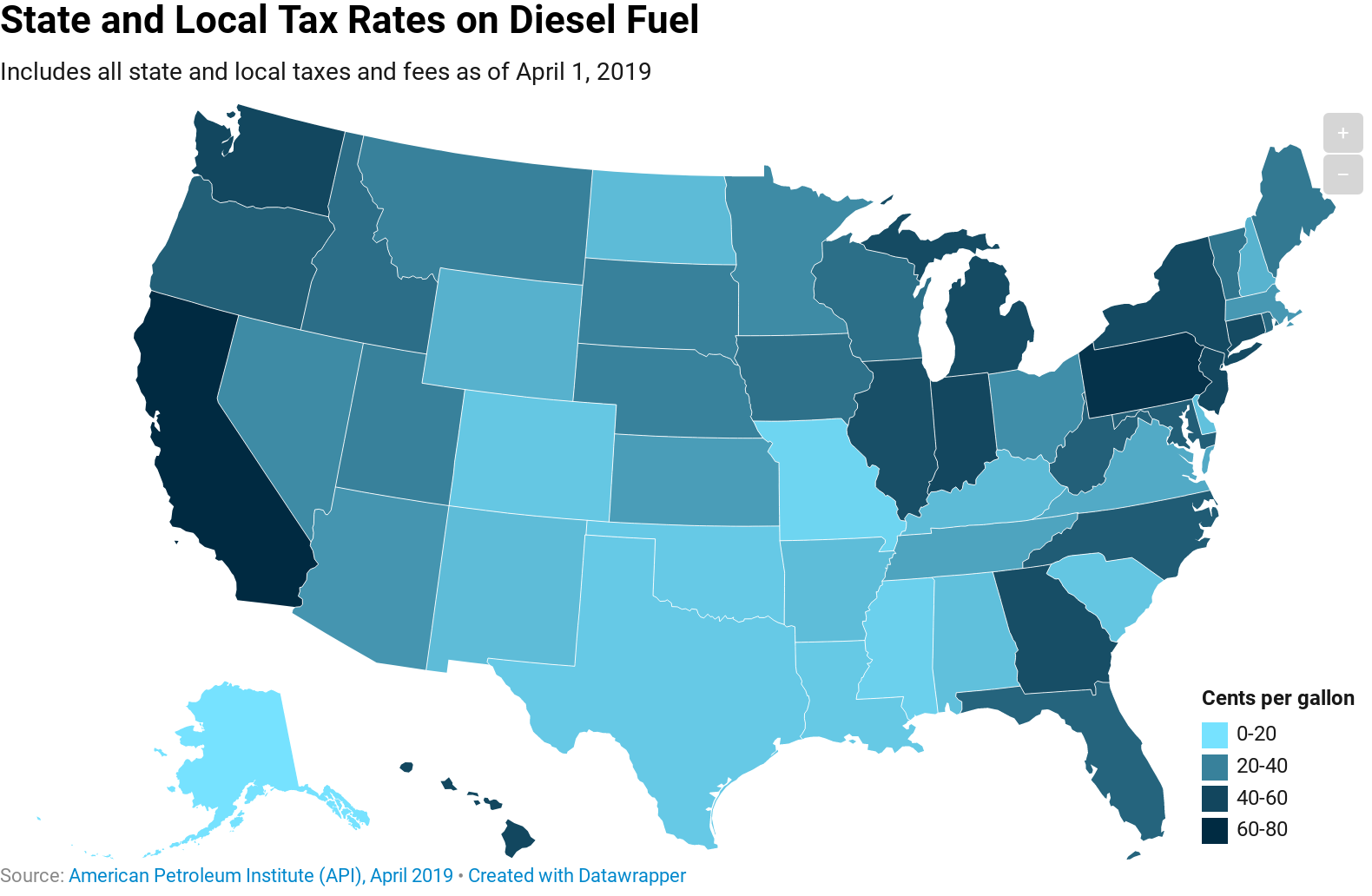

What Is The Diesel Fuel Tax Rate In Your State Itep